Car Fbt Calculation Example

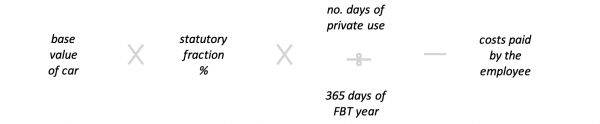

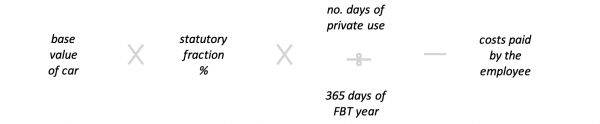

Currently it is 47 for the years ending 31 March 2018 to 31 March 2020. Employee contributions if any The formula.

Car Fringe Benefits Video Overview And Example For Uts Taxation Law Youtube

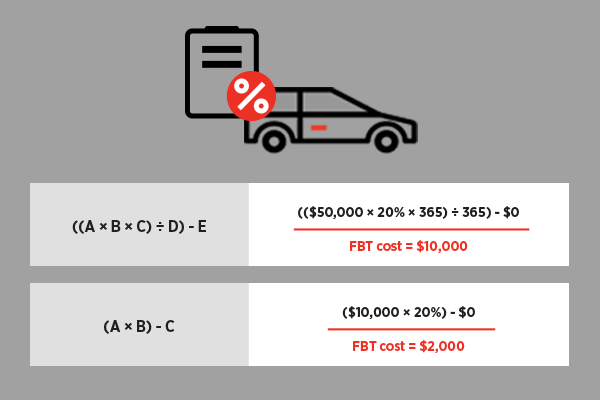

The cost to the business would be.

. In the past few years this has changed to a straight 20 of the FBT base value drive away price minus government on-road costs of the vehicle. Taxable value under statutory formula method. The best method ie.

Safeguards There are safeguards to make sure the true base. Employers may be liable to pay Fringe Benefit Tax on taxable value of such benefits provided. Higher gross-up rate type 1 is used where you or other benefit providers are entitled to a GST credit for GST paid on benefits provided to an.

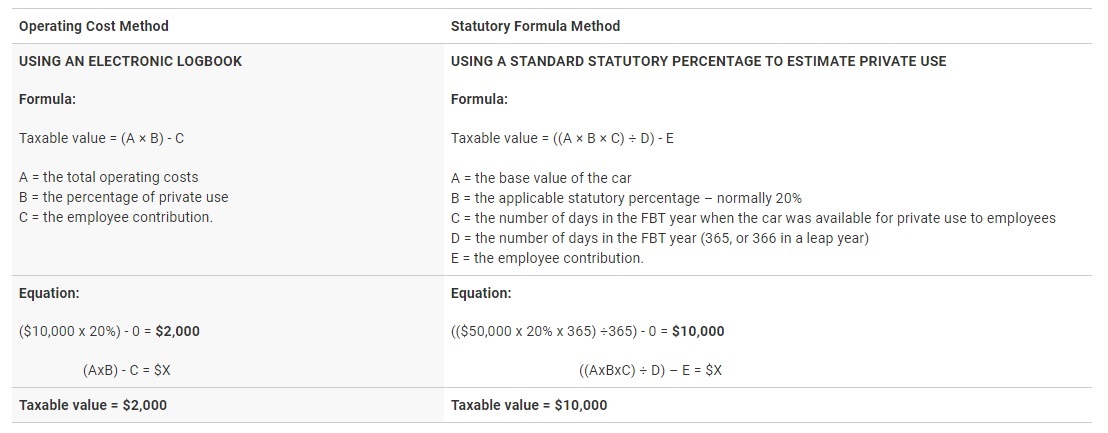

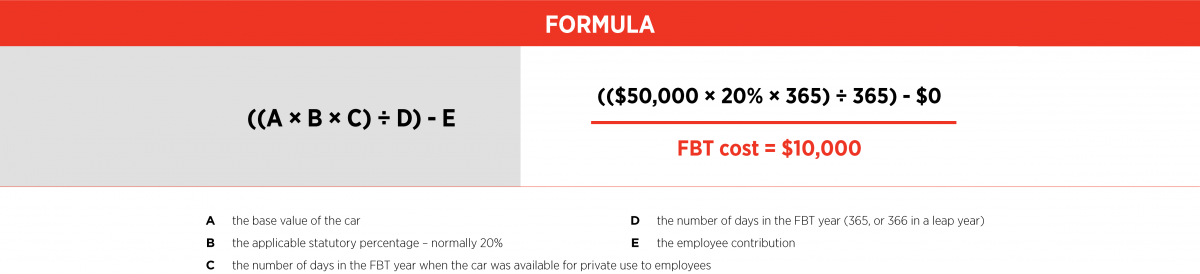

Maintenance costs of the car. The Fringe benefits tax FBT car calculator is designed to help employers calculate the taxable value of a car fringe benefit using either the statutory formula method or the operating cost method. How to calculate car parking fringe benefits.

XYZ Pty Ltd will have the choice of the statutory formula method or the operating cost method to calculate the taxable value of Johns car for FBT purposes which method should they adopt. The statutory FBT method is based on how much the vehicle costs rather than how much it is being used privately. You must complete this item because it and item 15 forms the basis of self-assessing any FBT liability.

The tax rate for FBT is much higher as compared to Income tax rate for the company or individuals. There are three possible ways to calculate FBT on cars. The original purchase including GST and luxury car tax but excluding stamp duty.

Minus Employee Contributions. Reducing the base value after four years An employer purchases a car for 30000 including GST on 1 July 2003. Fringe Benefits Tax.

Any other goods-carrying vehicle with a carrying capacity of less than one tonne such as a panel van or utility including four-wheel drive vehicles any other passenger-carrying vehicle designed to carry fewer than nine passengers. Applied Education pays rent of 5000 for an employee Brett Smith who lives and works permanently in Perth. Multiply the amount you wrote at item 15 by 47 the FBT rate for the year ending 31 March 2021 and write the total amount of tax payable at item 16 even if the amount is nil.

However if the logbook declares that the work use is. Note the base value of the car can be reduced by one third after the car has been held for four full FBT years. A sedan or station wagon.

Put simply the base value is the cars purchase price less stamp duty and any. It does not calculate the grossed-up value of the benefits or the tax payable. Using the vehicle in the first example for Taxable Value we start with a taxable value of 6000 for the entire year.

Use this calculator to work out FBT on all benefits provided when you file quarterly FBT returns. The 10000 car benefit is taxed as follows. The possible methods are.

There are a number of ways to determine taxable value of each benefit. If youve owned the car for less than 4 years when the FBT year began the base value is the original cost price of the car or ⅔ of the cost price if owned for more than 4 years. If the contribution collected post-tax deductions received was 5500 there would be a shortfall of 500 6000 - 5500.

Cost of motor vehicle. From 1 April 2003 and future FBT years. The statutory formula method based on the cars cost price or.

Car Parking Fringe Benefits Calculation Methods. Example calculation of Fringe Benefits Tax 1. Annualised kms 14255 5 x 365250 20805.

This would give rise to a taxable value of 12000 if the car was never used for work purposes. Assume a cars running costs for the year totalled 6000 and notional costs amounted to another 6000. The 100000 is taxed at the applicable PAYG withholding rate which you withhold and pay to the ATO.

The method with potentially lowest FBT impact will depend primarily on the cost of the vehicle extent of private use and the availability of substantiating records. The FBT payable would be. Each days parking for each person for more than 4 hours in total within the hours of 700 am and 700 pm is a benefit.

Assume you pay a staff member 100000 pa and provide a car benefit with a taxable value of 10000 during the 201920 FBT year. You can choose whichever method yields the lowest taxable value regardless of which method you used in a previous year. Base value 37000.

In the 1999 FBT year the base value would be reduced by one third at the commencement of the 2004 FBT year ie. To calculate the FBT payable on your Motor Vehicle using the Statutory Method for FBT year 2017-2018 Example. 16 Amount of tax payable.

For fringe benefits tax FBT purposes a car is any of the following. Allowing employees to use business vehicles for private use is a Car fringe benefit. Lower gross-up rate type 2 is used where there is no.

The FBT rates keep changing so you must check the rate before getting started. The employer can reduce the base value of the car by one-third 10000 in the FBT year beginning 1 April 2008. 5000 x 18868 as there is no GST in residential rent x 47 443398 in FBT would be payable.

The operating cost method based on the costs of operating the car. Number of days of private use. There are two different gross-up rates to calculate fringe benefits taxable amounts.

Enter the details into our calculator. GST Free Benefit like residential Rent. You can now work out all your FBT on one calculator depending on how you file.

The statutory percentages for Explains fringe benefits tax FBT Using the statutory fraction method FBT is 20 FBT liability 02 statutory fraction. Calculation of FBT on cars. For example if a car was purchased on 15 April 1998 ie.

Fringe benefit tax quarterly calculator. If the vehicle. The lower the taxable value of the car will be for FBT purposes.

For example is the vehicle drive away price was 20000 and the government on-road costs for registration and stamp duty were 2000 the FBT would be 20 of 18000 or 3600. The Best Way Of Calculating FBT. Fringe benefits tax car calculator.

Case study 1 - Solution. Go to this tool. Taxable value Cost of Car x Statutory Rate x Days Private Use 365.

The employer must himself or with the help of a bookkeeping company in Melbourne assess the FBT that needs to be paid as the ATO doesnt notify about the same. It uses a flat rate of 20 of the cars base value taking into account the number of days per year the vehicle is available for private use. To calculate the taxable value of a car fringe benefit an employer must use either.

FBT was introduced to deal with these kinds of tax evasion practices.

How To Calculate Fbt For Your Fleet Eroad Au

What Are Car Fringe Benefits And How To Minimize Your Car Fbt Liability

How To Calculate Fbt For Your Fleet Eroad Au

Car Fringe Benefits Gfa Accountants

Solutions Marketing Consulting Car Fbt Statutory Or Operating Cost Which Method To Choose

How To Calculate Fbt For Your Fleet Eroad Au

Fbt Operating Cost Method Worksheets

Solutions Marketing Consulting Car Fbt Statutory Or Operating Cost Which Method To Choose

0 Response to "Car Fbt Calculation Example"

Post a Comment